A Better Way to Fight Inflation

As the Reserve Bank of Australia signals even more interest rate increases ahead in an attempt to reign in Australia’s inflation, it is high time that we look at whether this is a reasonable strategy.

Firstly, much of the current spike in inflation is not driven by increased demand. It is clearly caused by supply-side issues: the global energy crisis caused by Russia’s attack on Ukraine, disruption (some would say collapse) of the global supply chain in the wake of Covid-19, and severe weather events largely due to global climate change. These and other factors have served to severly limit the supply of goods and services and has led to the spike in prices across the board.

Couple that with a severe shortage of accomodation, now being exarcebated by the resumption of immigration and the gradual return of overseas students, and it is no wonder that the headline inflation rate is so high.

But, “so high” compared to what?

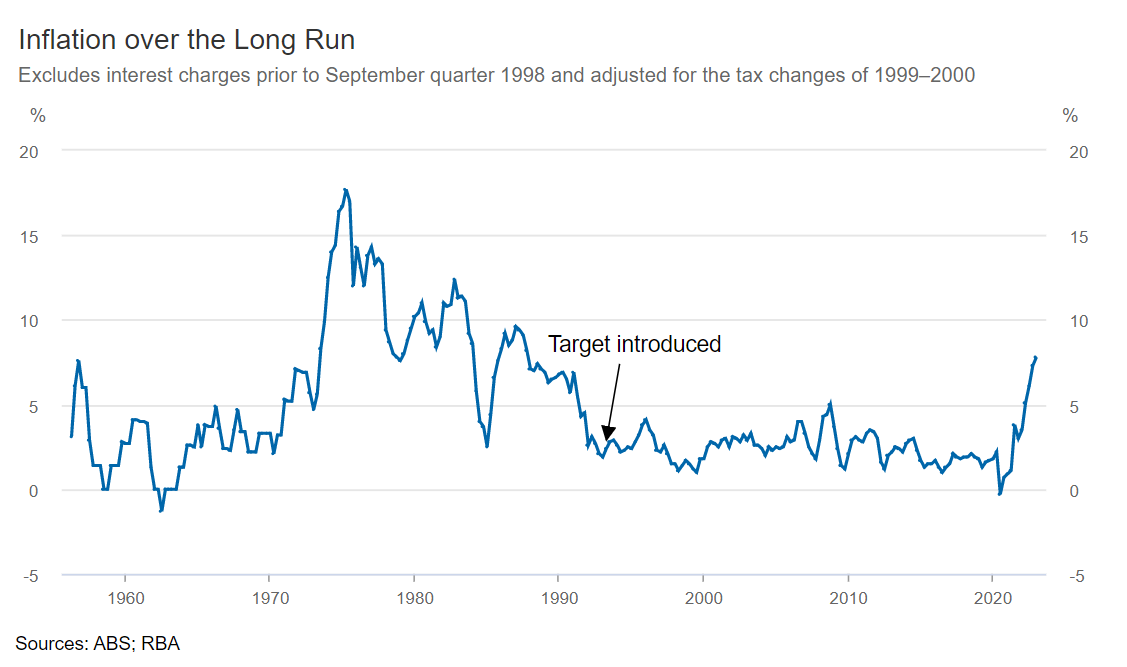

The RBA’s target headline inflation rate has been set at what is often seen as a sacrosanct 2-3%. This rate was adopted as a target in the early 1990s when that was the actual annual inflation rate and it was considered that a rate in that range would be sustainable in the long term. This was at a time that Australia had finally managed to get inflation under control after a decade or more of runaway inflation largely caused by a period of rapid wages growth.

But there is no magic in that range – this was just an observation at the time, and it does not take into account the local and global economic conditions in which the Australian economy finds itself.

But even if we allow that the current headline rate is too high and should be reigned in, we still need to ask the question: how?

The RBA, as an independent body, really only has a single lever to pull: interest rates. The logic is that, by raising interest rates, money is being pulled from circulation and therefore not available for spending on goods and services. The problem is that we are seeing inflation rising when purchasing power is declining.

Today’s inflation is clearly not wage-driven. Wages growth has lagged significanlty behind inflation for many years now. The causes, while not totally clear, are certainly not related to runaway wage growth.

Raising interest rates is really taking money from workers – those who create value in the form of goods and services – and giving it to the banks. In theory, banks would return the lion’s share of that additional income as interest paid out on deposits. Except, that has not happened. Instead, interest paid on deposits remains at historic lows, and bank profits have reached all-time highs as a result.

Is this a fair and equitable way to tackle inflation? Is this the way to slow down spending? Taking it from people and essentially giving it as a gift to banks seems to me to be totally counterproductive.

Is there an alternative?

Yes. Yes, there is.

British economist John Maynard Keynes proposed an approach at the beginning of World War II, when he was thinking of ways to control inflation. This was at a time when Britain’s economic activity was being fully directed at the war effort.

In his essay How to Pay for the War (1940), he talks about the economics of compulsory saving.

Keyes observes that, in a war economy when everyone who can and wants to work will have a job, it is inevitable that people will have excess disposable income. He then asks what can be done to prevent people from spending their additional money to compete for scarce resources and thereby cause domestic inflation. He goes on to state that there are two strategies to achieve this: you can eliminate people’s ability to spent too much my taking it from them (for example, by raising taxes, or by increasing interest rates to transfer money from household to banks as a form of financial rent) or you can postpone their ability to spend too much with mandated savings of some kind.

Keynes argues that it would be much fairer to postpone peoples’ ability to spend, because it would allow workers to keep the money they’d worked hard for:

For each individual it is a great advantage to retain the rights over the fruits of his labour even though he must put off the enjoyment of them. His personal wealth is thus increased.

This suggests to us the way out. A suitable proportion of each man’s earnings must take the form of deferred pay.

(Let’s set aside the old-fashioned use of “man” for person – he was of course a product of his time.)

He goes on to explore how that might work, with employers certifying that some amount has been paid into an approved fund of the worker’s choosing, to be released at some future time when the economy was not under inflationary pressure.

Does that sound familiar? Does that not remind you of how our Superannuation system works?

Instead of using the painful and patently unfair instrument of interest rate hikes to try to reign in inflation by taking money (forever) from households and giving it to banks, why not increase the mandatory contribution into superannuation funds by workers, thereby still rewarding them for their work but preventing them from spending it at this time. Obviously, this would need to be an increased contribution by the employee, thereby decreasing their take-home pay, not an increased employer contribution.

Yes, this would still hurt. But at least the money would still be theirs, invested for them to be used later when needed in retirement.

And let’s not forget that interest rate rises really only affect those households that have mortgages. That’s roughly only one third of Australian households. Those who have no mortgage (and even those with very small mortgages) are largely unaffected by interest rates. This means that interest rate hikes need to be even greater, because that one third of households – the most vulnerable ones – need to do the heavy lifting in suffering from the permanent loss of money that is being redirected to the banks.

Now, I understand that the RBA sets interest rates independently from the government, and the government controls superannuation. But that doesn’t mean that the two can’t talk!

I don’t see anything improper in the government (the Treasurer and his department) liaising with the RBA Board to agree on an approach, in the form of “we’ll impose a short-term mandatory employee superannuation contribution of x% in lieu of you raising interest rates by y%”. Generally, the superannuation contribution increase would be significantly less (as a percentage) than the interest rate increase. This is because it would be more broadly based (every worker would be affected, not just mortgage holders) and it would be on total income, not just on housing costs.

This approach would be fairer in many ways. It would not target just those households with mortgages by requiring a small fraction of everyone’s income to be unavailable for spending. It would not funnel money to banks but instead put it into people’s own savings, available for them to use in retirement. It might even provide some small easing of budgetary pressure for age pensions.

We really need this to be examined urgently. Any further interest rate rises are going to push recent borrowers over the servicability buffer required by prudential guidelines. And that’s going to cause a world of hurt to vulnerable young families.